Millage rate calculator

Ok just use the millage calculator. Enter millage rate.

Millage Rates And Real Estate Property Taxes For Macomb County Michigan

The State millage rate on all real and personal property has been phased out.

. Assessed Value x Millage Rate Unadjusted less exemptions Tax Bill. Use this Louisiana property tax calculator to estimate your annual property tax payment. Senior Exemptions are not taken into account for the estimated tax amount.

Millage is the tax rate expressed in decimal form. Enter County Millage. Clair County Community College district pay taxes to support SC4 through a voter-approved millage rate.

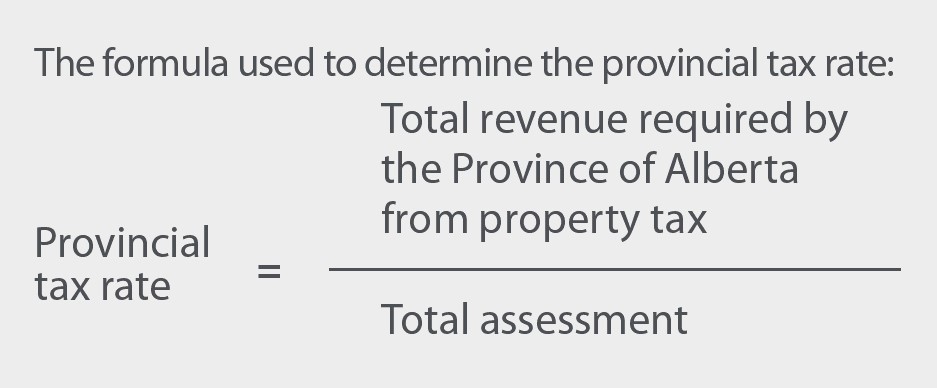

To find the propertys tax amount millage rates are applied to the total taxable value of the land. In 2015 the State millage rate was 05. The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate.

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. What is a millage rate. This home is located at 5009 W Estuary St Eagle Id.

The amount that you owe each year depends on the assessed value of your property including your house itself and the land that it sits on. This is equal to the median property tax paid as a percentage of the median home value in your county. One hundred 100 mills ten cents or 010.

Enter Municipality Millage. Millage rates are determined by the county commissions and other taxing agencies. Make sure you review your tax card and look at comparable homes.

This rate can and often does change from year to year and is based on the needs of the local city and county governments as well as the needs of local school districts. However Sakuma noted its substantially less than the 42925 fee proposed in July. A millage rate is one tenth of a percent which equates to 1 in taxes.

This tax estimator is based on the average millage rate of all Broward municipalities. It represents the number of dollars taxed per every 1000 of a propertys assessed value. Enter School District Millage.

You may see this rate referred to as a mill rate or a millage rate. Inside Mobile and Pritchard the additional millage is 120 while outside those two cities the additional millage is just 40. Unless the calculator on my iPhone deceives me that would be about a 55 increase.

Plan your route estimate fuel costs and compare vehicles. Residents of the St. Then you could use a property tax calculator to come up.

1 You have chosen. In each jurisdiction a local taxing authority sets a rate that each home will be taxed at. For example if the local property tax rate on homes is 15 mills homeowners pay 15 in tax for every 1000 in assessed home value.

Clair County who reside in Anchor Bay Armada Richmond Brown City or Croswell-Lexington school. Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. A tax rate of one mill represents a tax liability of one dollar per 1000 of assessed value.

1000 mills one dollar or 100. Lastly there are additional city property taxes in 10 Mobile County cities. In our calculator we take your home value and multiply that by your countys effective property tax rate.

In Mobile city the municipal rate is 70 which brings the total millage rate for residents of Mobile city to 635. The rate for these types of contracts is 35 cents per 100 of value. This estimate does not include any Non-Ad Valorem assessmentsFees Fire Garbage Light Drainage.

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. The current SC4 district is based upon St. A stamp tax of 70 cents per 100 of value is assessed on documents that transfer interest in Florida real estate such as warranty deeds and quitclaim deeds.

Property taxes sometimes referred to as a millage rate or a mill tax is a tax that you pay on real estate and other distinct types of property. On January 1 2016 there was no State levy for ad valorem taxation. Once the assessed value of your property has been determined multiply it by the appropriate millage rate for the area in which you live.

A mill is one-tenth of one cent 001 1 mill 0001. Accordingly a house with a 200000 assessed value would be. Clair County K-12 school districts and does not include persons living in St.

You can move the decimals by 10 100 or 1000. A millage rate is the tax rate used to calculate local property taxes. Once the Assessed Value of your property has been determined multiply it by the appropriate Millage Rate for the area in which you live.

The Estimated Tax is just that an estimated value based upon the average Millage Rate of 200131 mills or 200131. Enter Other TOTAL MILLS. The average county and municipal millage rate is 30 mills.

If you would like to calculate the estimated taxes on a specific property use the tax estimator on the. Your Taxes may be higher or lower. A tax is also levied on notes bonds mortgages liens and other written obligations to pay that are filed or recorded in Florida.

Property taxes in Florida are implemented in millage rates.

Property Tax How To Calculate Local Considerations

Property Tax Millage Rate 13 Things 2022 You Need To Know

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

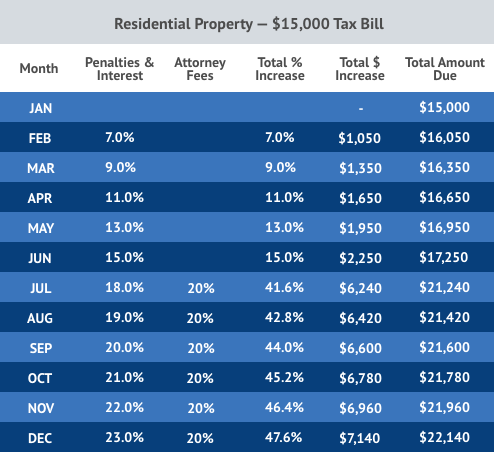

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Tax Rates Gordon County Government

Washington County School District Tax Rates Millage

Montgomery County Tn

Hennepin County Mn Property Tax Calculator Smartasset

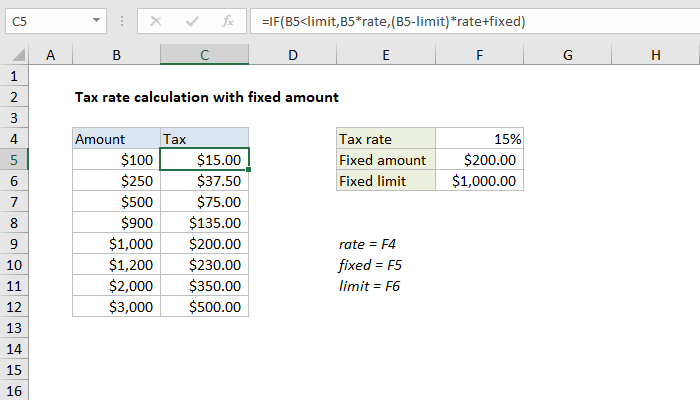

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Property Tax Tax Rate And Bill Calculation

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

The Property Tax Equation

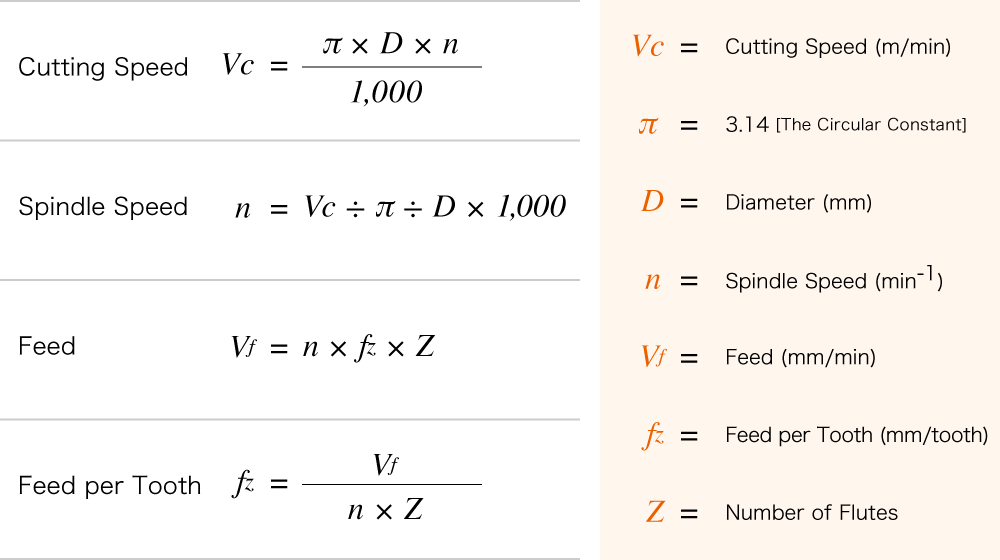

Calculation For Cutting Speed Spindle Speed And Feed Ns Tool Co Ltd

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Tax Calculator

Property Tax Millage Rate 13 Things 2022 You Need To Know

Nyc Nys Transfer Tax Calculator For Sellers Hauseit